Airlines including Lufthansa, British Airways, Iberia and American have announced direct connect initiatives via NDC. They either introduced charges to book through a GDS or will be offering additional capabilities if booked directly through their NDC interface. When it comes to costs (or certain fares not being available in preferred channels) it affects everybody. It sounds so easy to use NDC, but the reality is: Not too many bookings are being made – especially for business travel. Why is that?

GDSs won’t just give up the battlefield of simple bookings (call it ‘easily earned money’) and only deal with the complicated PNRs. While I am critical of the global distribution system “oligopoly”, the sustainability of the redrawn commercial and technological landscape that NDC could produce has to be questioned. The proposition of NDC means that a “formerly relatively lean distribution chain will become a complicated commercial landscape with numerous airlines, numerous TMCs (or corporations) and several technology providers – all being connected to each other on a technological, as well as commercial, level.”

Some travel history

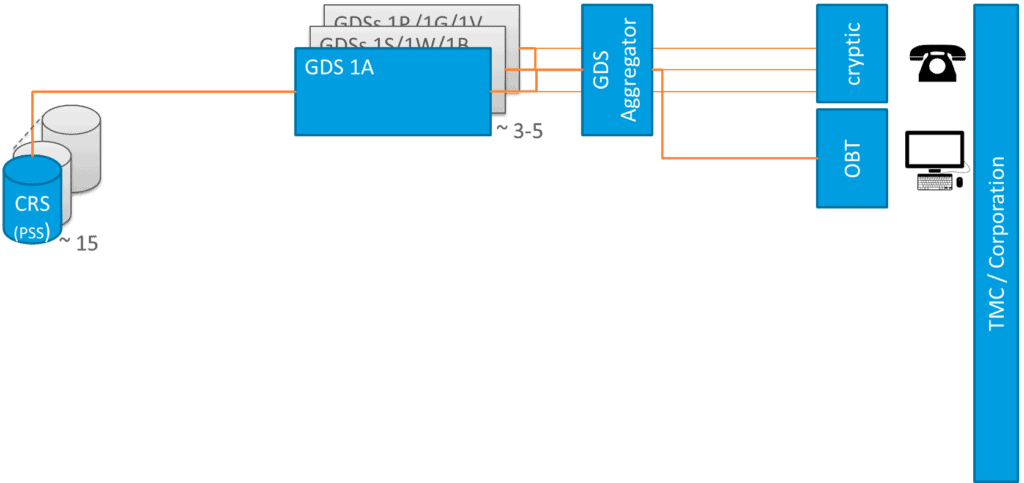

Let me start with taking a look at the history of travel: Airline inventory is held in the Central Reservation System – CRS (which is today part of the Passenger Service System – PSS) and in the old days was made available by the Global Distribution Systems (GDSs) to agents via cryptic screens. The traveler actually used to call a travel agent to make a reservation.

With the success of the internet, at the end of last century, Online Booking Tools (OBT) were introduced and along with that, since not every OBT provider wanted to integrate with each GDS separately, GDS aggregators including ourselves emerged. While GDSs “spoke” (and still “speak”) GDS specific language, GDS aggregators translate that into a unified XML which remains constant across GDSs.

What is NDC?

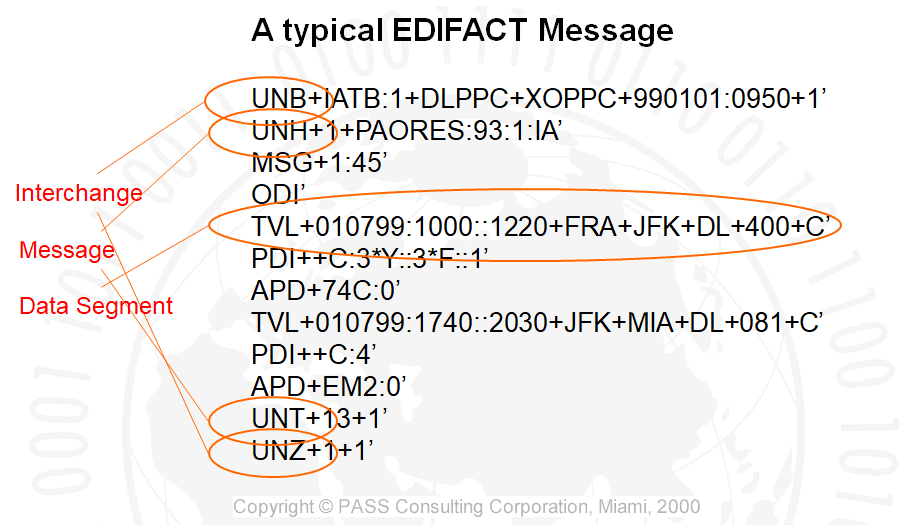

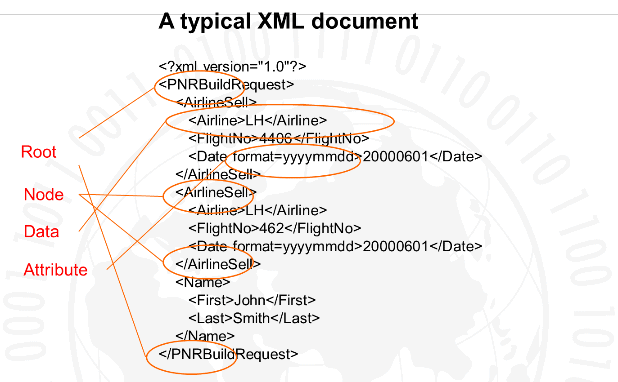

Now, what is NDC? NDC stands for New Distribution Capability. I was always told not to use “New” in any product name, because in a year from today or in 10 years, is it still considered “new”, but this is what IATA chose. NDC has two major aspects in my understanding. First, it is a new communication protocol that replaces a protocol which has been around since the 1980s (EDIFACT – Electronic Data Interchange for Administration, Commerce and Transport) with a new standard (XML – Extended Markup Language).

EDIFACT Message vs. XML document:

The first version of the IATA NDC schema was actually our XML schema which we created around the turn of the century. Developers today prefer JSON (JavaScript Object Notation) and rapid API development and run when they hear XML. Hence an argument can be made that this is not so “new” after all.

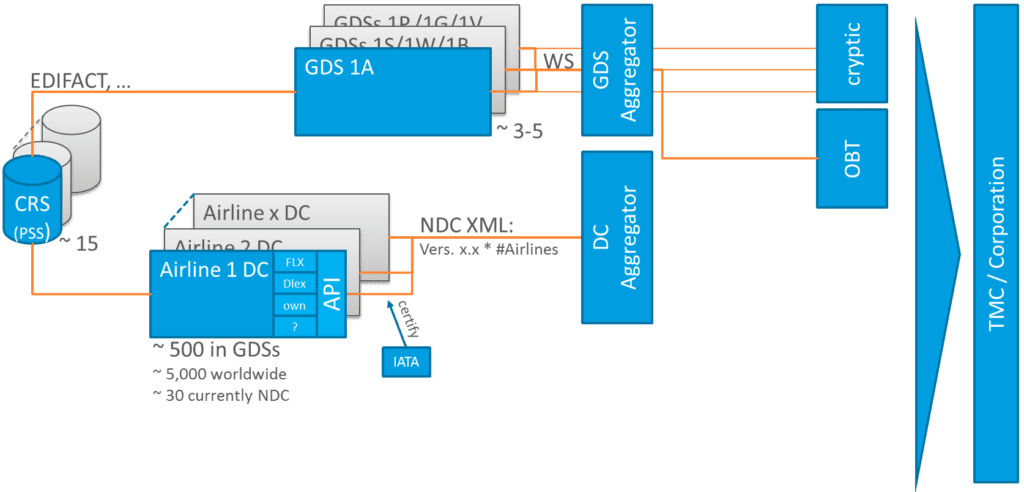

The other aspect of NDC is that airlines want to take control of the distribution, such as provide offers based on ‘who is asking’, price ancillaries etc. – in order to differentiate from each other. Example could be Michael Strauss, not a good client, let’s offer him no direct flights and only middle seats. Or, what Lufthansa actually wants to offer is Bavarian brewery tours for passengers with long stopovers in Munich. To achieve these wishes, airlines contracted with technology providers or started their own initiative to hook into CRSs and provide their own API (Application Programming Interface). This is now called NDC XML and at this time (Oct. 2017) there are approx. 18 versions around. As I mentioned, the 1st version was our XML schema, but it has changed a lot since then. Presently a new version comes out every six months.

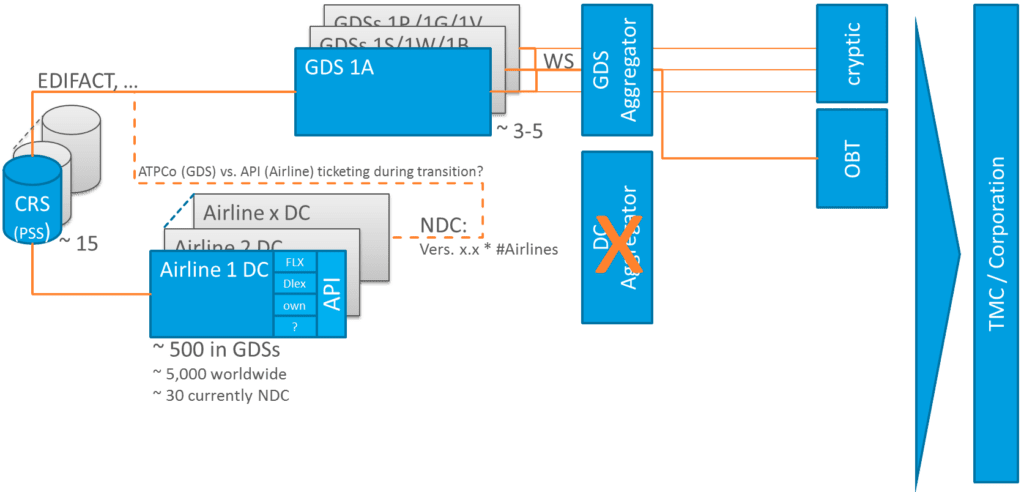

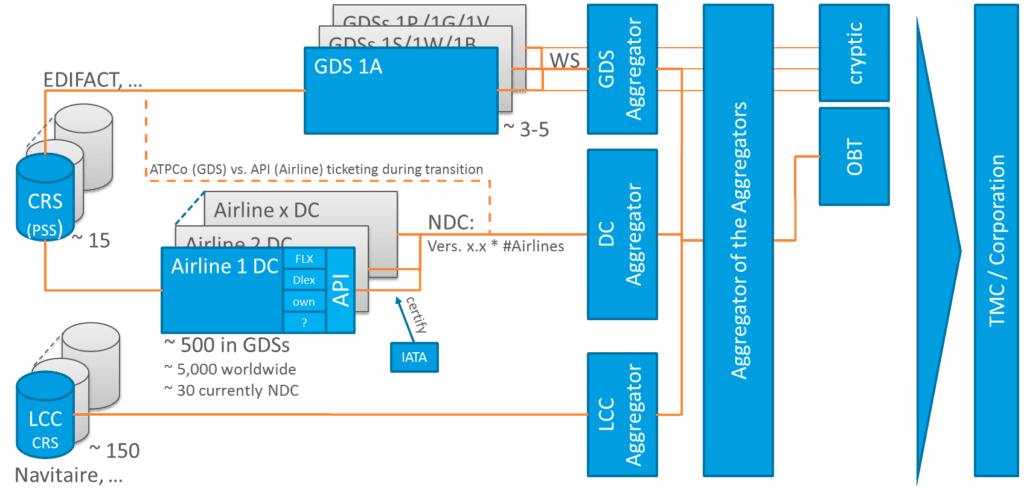

If we look at the numbers, we have up to 500 airlines in various GDSs (there are actually 5,000 airlines worldwide and 30 currently considering NDC as an option) and one would have to develop and maintain a magnitude of various NDC versions with multiple airlines (up to 500). IATA (International Air Transport Association) promises to certify NDC connections, however, it remains to be seen how this will play out. As airlines want to use this vehicle to differentiate themselves and have no desire to be easily comparable with a competing carrier, I strongly believe each airline will have their own “interpretation” of NDC (even British Airways / Iberia decided to use a different approach than OneWorld alliance partner American; Lufthansa does not even use one of the published IATA NDC version but their own flavor of it). Security breaches are on the rise, and companies are trying to encapsulated their systems rather than opening them up. In this example, what used to be a closed environment of a few handful of CRS provider hooking into one handful of GDSs, who open themselves only to a limited number of authorized developers, now appear to open up APIs to everybody. This may be an ultimate risk that needs to be managed. GDSs also warn to be careful what you wish for: can airlines handle the traffic. In business travel, a look-to-book of 5:1 is maybe something everybody can handle, but are airlines prepared to handle traffic from numerous institutions worldwide, with numerous shopping request? Long story short, there is absolutely no way that every TMC or even every corporation can integrate with all airlines, which means we need a direct connect aggregator.

Will GDSs become the NDC aggregator?

Let’s take a step back: Ideally it would be the easiest if the GDSs would just unplug the EDIFACT pipeline and plug in the NDC pipeline. However, not all airlines will migrate to NDC at the same time which would mean a transition period and among the challenges, there is also the unresolved problem who does the ticketing: ATPCo airlines ticket in the GDS, while NDC API bookings are ticketed with the airline. And that’s besides commercial aspects. Consequently, this won’t happen overnight. Despite the fact that TMCs request GDSs to evolve, as usually all the TMC infrastructure is built on top of GDSs, this may only be a solution for the future and it is not something which is available today. Some TMCs see the effort to switch to NDC similar complicated as a switch of the PSS system of an airline.

Some airlines suggest to wait if the GDSs pick up the pace, but if a solution today is needed, we are stuck to the Direct Connect aggregators. Unfortunately, it doesn’t stop here: We also have Low Cost Carriers (LCCs) – and there is about 150 of them, and there already have emerged LCC aggregators for low cost carriers – which is a tough part as some of these LCCs can only be integrated via website screen scraping.

Aggregator of the aggregators

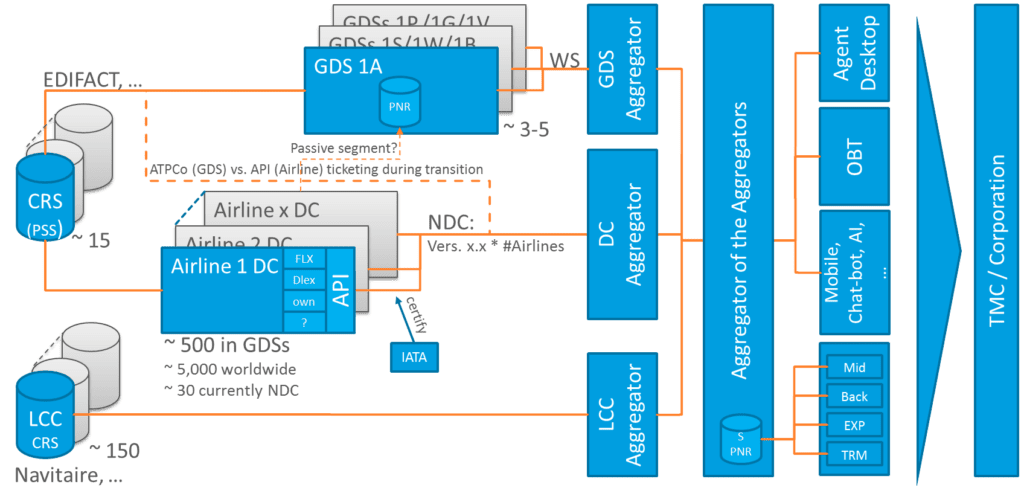

Now we have the GDS aggregators, the Direct Connect aggregators and the LCC aggregators (and this is just for air) which means we need the aggregator of the aggregators.

We also need a multi-source Agent Desktop now, because not all bookings can be serviced by GDS cryptic screens anymore. In addition, we cannot close our eyes to the internet age we live in, which means we have mobile interfaces, chatbots, artificial intelligence leading to virtual agents, and things we probably cannot even imagine today. And, we have Midoffice, Backoffice, Expense Management and Travel Risk Management / Duty of Care provider, who used to get their information from the remarks of the PNR database of the GDS, but now since not all PNRs reside in the GDS, and GDSs (at least some) have made it very clear that passive segments are not an option for direct connect bookings (or at a minimum they come at a cost), we may also need a Super-PNR (SPNR-) Database.

It seems to be a battlefield

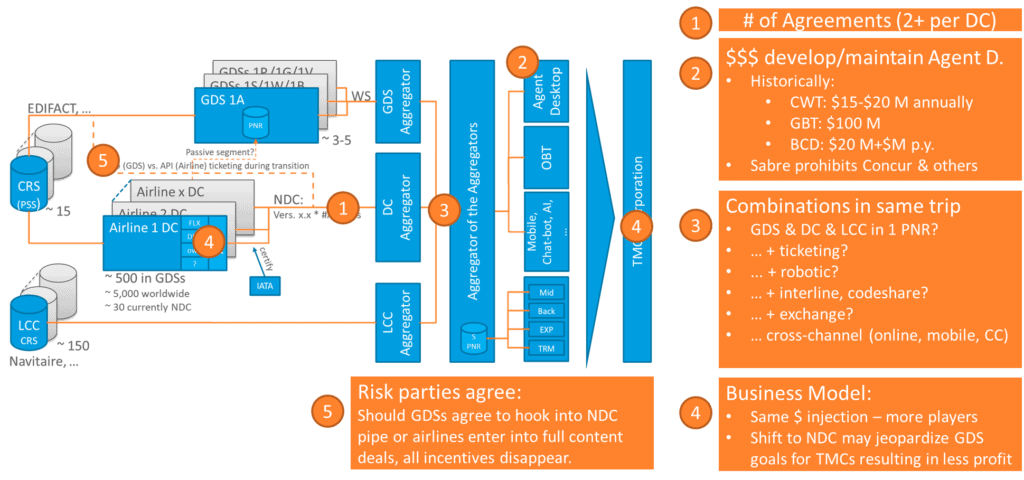

People approach and tell me that I should be so happy as we are well positioned to become this Mega-Aggregator, but I always respond that I’m not. First, this seems to be a lot of time and resources wasted to develop something which is already to some extent here. Then there is no money in this: distribution cost is going down – even if airlines wanted to pour more money into distribution (which they don’t want to), there are more players on the field who want to get a piece of the pie. It is also a big gamble as the minute airlines and GDSs agree on full content deals and hooking the pipe into the NDC pipeline all this goes away. And, it seems to be a battlefield. We have been “Switzerland in a war zone” for almost two decades: It has never been easy to be neutral in a world of 3-5 GDSs. Now we are talking about way more players and each in competition with each other. Farelogix used to be in the business of becoming the big aggregator (as they had the technology because they built on our technology), but lost all their leverage when they lost their GDS agreements. Now from a value chain perspective, they have only a small presence as an airline API provider. This does not mean they are small or irrelevant to the business in total. To be one of the NDC provider and enable ancillary shopping, interlines etc. is still a huge undertaking.

Plus, let’s not forget that GDSs have already secured their own spots in the new world: Amadeus for instance has the CRS/PSS Altea, own LCC CRS Navitaire and are in business as a LCC aggregator with Pyton. They also have their own GDS, own Agent Desktop and two OBTs (E-Travel and Cytric), along with GDS aggregation capabilities from PASS. On the remaining items (mobile etc.) they partner or acquire. Finally, Amadeus has also successfully cannibalized itself by bypassing their GDS and hooking Cytric directly into Altea (the PSS of Lufthansa) for Siemens and Volkswagen.

Commercial challenges

This is only the technical landscape – so, now if we look at some commercial aspects it becomes even more worrisome:

- It takes a number of agreements for each direct connect. For Lufthansa for instance we have an agreement with their technology provider Farelogix, but also one with Lufthansa itself to be allowed to technically access their system and our clients need a content agreement with Lufthansa, to be allowed to see and book the inventory through us.

- Source agnostic Agent Desktops are not easy to develop – as we are doing this right now, we know this first hand. Historically TMCs have burned a lot of money in such endeavors: CWT’s Symphonie was estimated to cost $15-$20 million annually. American Express GBT’s Travelbaan was reported to have cost $100M and BCD’s Renaissance cost around $20 million and millions annually to maintain. All these Agent Desktops have since been sunset. Obviously, today’s technology allow better commercials, but still it is a challenge. In addition, some of the GDSs prohibit an Agent Desktop that compares their rates with other content.

- While I’m sure there are trips which can be better maintained by NDC, there are also trips which will be a nightmare when they have segments of different sources – such as one leg is a GDS booking, the next one a Direct Connect Booking, the 3rd one a low cost carrier. How do you shop these? How can you compare apples to apples? Where are those trips ticketed – most likely in different systems. Add robotic ticketing to the mix or interline/codeshare bookings. I’m not sure if this has all been tested yet. But even if this all works, have fun with a change of plan of your traveler. Exchange in multiple sources will be interesting to see how far this can be automated. And then you obviously need to support this via different channels. While the bookings may be done through the OBT, the change may be requested through mobile. That’s all going to be addressed by artificial intelligence?! Good luck with that! Another concern is speed: The ATPCo pipe has proven to be fast and effective – any API will need to have similar speeds, similar resistance, up time of 99.9 percent or more.

- Another issue is the business model. All this new technology will have to be developed and such development costs. While the airlines say they want to inject the same amount of money, just the industry shall distribute it differently as needed, this may be a challenge: It seems like there are more players (such as the aggregators, but also the technology provider of the airline API), which means less money for more entities. American says it already (in 2017) distributes 4 million tickets via NDC (which in fact is only 2% annually of their carried passengers). But even if this number significantly increases it will never reach 100%. Let’s assume 80% of tickets are distributed direct, how expensive must the distribution of the remaining 20% become in order to maintain all this legacy (but working) technology. I cannot see GDSs being able to cut costs by 80%. Or maybe the PNR in the PSS needs to become more expensive as most airlines are hooked into their PSS which coincidentally is also provided mostly by the same GDS companies. Not to forget that TMCs may face a challenge as they may have goals to achieve with GDSs. If they do not achieve those goals they may receive less bonuses (incentives, commissions, and/or overrides) from the GDSs – hence a shift to NDC may jeopardizes their GDS revenue. This might be a risky undertaking and require some technology to maximize their profits (or better minimize their losses).

- And finally, it all comes down to what airlines and GDSs agree upon. Let’s assume we figure this whole picture out and find it lucrative for everybody, and all of a sudden, some new leaders from the airlines and GDSs sit at a table and agree on GDSs to hook into NDC themselves and all the other endeavors fade away. Lufthansa for instance mentioned that the harsher stance they took is mainly to force GDSs to catch up with technology. Delta continues to provide full content to GDSs as they feel building out lots of direct connects “sounds like recreating what is there” (which sounds different to their stance in 2011).

Solutions instead of protectionism

I’m a big advocate of breaking apart the GDS oligopoly, but it needs to make sense and not just create a ridiculous amount of extra work. I believe we better get our act together sooner rather than later and work on solutions instead of protectionism. It seems like we totally underestimate the power of a few major players in the internet world (Amazon, Apple, Google, Facebook and Microsoft). A simple comparison: GDSs regard the ownership of the PNRs as a major USP – and to some extent, this can even be considered double dipping with charging for the same PNR in the PSS as well as the GDS and potentially other locations. And what is a PNR? A text record of not even 1 KB? You can store pictures up to 5 GB with any cloud provider for free. Hence, I can easily store more than five Million trips at one cloud provider – more trips than I will ever take – not even considering I just need the upcoming trips stored and can abandon the ones which have been completed. Maybe it would be wise to understand that a PNR is not the property of a GDS but the property of the traveler.

Even wiser would be to do something with all that data that is being collected and/or encourage startups to see how anyone can benefit (obviously anonymized in order to take security and privacy concerns in consideration). The box mobile, chatbot, artificial intelligence is completely underrepresented in my graphic. This will be the future – to ask Alexa or Siri to book your hotel room on your upcoming trip and show in virtual reality amenities on your TV screen in order to make an informed decision. A CRS, GDS or even PSS may still be considered rocket science by some individuals today, but like in the music industry, don’t expect the world never to change.

Travel XML API

Latest News

On Nov. 14, 2018, Sabre Corporation announced to acquire Farelogix for $360M. Foes become friends?! The following weeks will show what this means for NDC. Airlines such as Lufthansa were working so hard to get out of the claws of the GDS, featuring a new player – only to find themselves back between Sabre and Amadeus. Sabre may also welcome the direct connect into Amadeus Altea. Stay tuned for updates.

21-03-2018

Lufthansa has announced to exclusively sell their ‘Best Fares‘ (e.g. Light and Classic economy) through lower cost channels such as direct (their own website) or NDC starting in April 2018. Additionally, traveler who book through those channels will get additional frequent-flyer miles. This goes along with Prof. Dr. Stephan Bingemer’s presentation on ITB 2018 that “If no incentive is paid [to agencies] then content [the fare] needs to be the new currency”. The lack of clear commercial models has always been an inhibitor of successful distribution models. This step by Lufthansa cleared those lacking commercial models and could theoretically lead to a whole wave to such direct connects (British Airways presumably has similar plans) – wouldn’t there be the full content agreements: In an article by the Beat [paywall] it is claimed that US airlines would love to do the same, but are prohibited by their GDS contract “provisions that disallow airlines from surcharging GDS bookings or from discounting airfares on direct websites” – those provisions (usually referred to as full content) which Lufthansa denied to sign. Not being bound by those provisions costs the airline more for those bookings actually made on a GDS (as the airlines does not get a discount any longer – leaked amounts of such fees can be found here) which Lufthansa passes along to the agency but it does not tie their hands any longer to provide better fares through lower cost channels. So, why do US airlines not just simply opt out of full content provisions as well? Obviously, as just mentioned, there is a cost to those remaining bookings made on the GDS which will increase significantly per booking (even with a shift to direct connect channels, an airline will not save significantly on overall costs to GDSs), but the US airlines biggest fear is, as pointed out in above referenced article, that the GDS cold “bias its content in shopping displays for GDS subscribers” – a “lucrative corporate audience”. The question then becomes, why was Lufthansa able to pull it off? And why was Lufthansa able to achieve record earnings before taxes of almost € 3 Billion despite their questioned NDC strategy? They are dominant in their home market. With the bankruptcy of Air Berlin, there is no real competition and no other airlines would immediately pick up the lucrative corporate market segment. The only domestic competition may be Deutsche Bahn and within Europe low cost airlines such as easyJet.

Frequently Asked Questions

NDC is a standard to which airlines can build their API (Application Programming Interface). It is based on XML (I think, the 1st version was actually our XML), which is a language becoming widely successful around the year 2000, to replace an earlier communication language between airlines and providers called EDIFACT (from the 1980s). So, essentially a very old technology is replaced by an aged technology and that is considered “New Distribution Capabilities”. However, an API needs to have a robust schema and XML brings that to the table.

Along with NDC, airlines are also changing the shopping process: previously an offer was created by the GDS based on fare, schedule and availability, in NDC, the airline creates the offer and with that can also provide add-ons such as WiFi, lounge access, pre-boarding and other things. In other words, it also allows to personalize offer. It can also mean that a company negotiates with an airlines special business class seats which may only be available to the executives. Consequently, it may help with data collection as well.

In short: it is supposed to be the plumbing behind the supply chain that the enables a consumer like travel experience.

People may argue (including myself as a technology provider who regularly has to sign off on the time sheets our developers spend) that we have not been there as of 2018. As of 2018 NDC is widely not considered a standard. The XML schema may be a standard, but offerings vary from airline to airline. Some include interline, some not, the form of payment is always a fun part, and we definitely have fun with exchanges.

Since its introduction in 2012, there have been 18 different versions of NDC as of the beginning of 2018. NDC implementation of two airlines do not look the same – it appears each airline has their own customized API. Somebody said that airlines have a tendency to ignore what IATA put into place. Airlines are at an all-time high. Load factor is at an all-time high. They publicly claimed they will never lose money again. How do you get them to respect and play like a team player? This fact doesn’t make life for those trying to consume the XML schemas easy. In fact, there might be higher cost than using the traditional channels. Aggregators want to make money as well – and add more complexity. In order to proceed we need to have IATA publishing clear guidelines, documentation, tutorials and examples how NDC schemas should be used – besides making sure that any new version provides backward compatibility. A source from IATA told me that with early adopters there is always chaos, but with 17.2 (2nd version of 2017), three GDSs and other IT companies are ready for industrialization. There will be two new versions per year in future, however, these will be just evolution. Let’s keep our fingers crossed that this is the case. Makes adoption easier and for those using the schemas it will mean that once they can talk to 1 airline, it will work with most others.

NDC implementation requires fundamental changes on how airlines, GDSs, TMCs and booking tools interact with each other. Big changes to the technology but also to the commercial model. The financial relationship between GDSs and TMCs for example is a multi-billion Dollar relationship. There are many who do not like change and definitely not when the change costs money and we do not know who is going to pay for it. There is also concerns about cutting out the middlemen. Reporting as well as duty of care is something, no airline has figured out yet and hence the TMCs are always in the mix and so is a central database where all the PNRs are stored which pretty much sounds like a GDS. And this suggests GDSs will stay in the mix. So, the question becomes what will actually change? IATA said, NDC is about replicating the agility, airlines have on their website, through the travel agent channel and the overall generic business case for NDC is about incremental revenues through more sales via travel agents (Meta-search, OTAs, TMCs, etc.) – so, is it just a vehicle to force the agency channel to speed up innovation? The commercial model should not hold back what we all want; however, uncertainty may limit progress and the idea of a new standard was to reduce complexity, but is this really the case?

I do believe NDC is here to stay from a technical perspective. Indeed, the uptake is not high, and the reasons are mentioned in this blogpost. Now with a GDS (Sabre) taking over a major airline NDC provider (Farelogix), it becomes even more likely, that GDSs just unplug the EDIFACT pipe and connect the NDC pipe. The same source at IATA told me, that 2018 has been a year of plumbing and so will the first part of 2019. The big pick up in numbers is dependent on the GDSs and all 3 have shared roadmaps in 2019 that suggest they will all be in “plug and play” mode between Q2 and H2 2019. The journey is only starting! The entire value chain is engaged: Airlines, GDSs and another 59 tech companies, large and small TMCs are now publicly engaged, Expedia group have said they are “Leading the adoption of NDC” (blog by Mark Hollyhead CCO Egencia on behalf of Expedia group) and so are Skyscanner.

The future commercial model remains a fog though. As of 2018, NDC has not been thought-through (especially for business travel) and not everybody is pulling in the same direction. From a commercial model, GDSs want to preserve the status quo and charge for inventory and distribution (essentially double-dip). GDSs want full content deals and TMCs have put all their eggs into the GDS baskets and still receive a significant kickback – plus there is a significant integration cost nobody knows who wants to pick up the bill, and one has to maintain several interfaces going forward. The largest TMCs have meanwhile introduced fees if a booking is created around the GDSs since there is an extra cost to service such bookings in the backend. You also need a Super-PNR and all backoffice provider need to integrate with such Super-PNR. Some GDSs prohibit the creation of passive segments unless they are an approved supplier (which NDC carrier are not). So, plenty of hurdles and for now, I only see the possibility GDSs integrating NDC themselves. And they seem to jump on the train with a little delay.

Now that the GDSs are further along with their technology (or acquisition), NDC seems to be used as something which it was originally intended for – a newer and better standard: replacing a several decades old EDIFACT standard, by a ‘newer’ (meanwhile also already ‘aged’) XML schema. This provides airlines with new ways to present, distribute and sell their inventory. It will still be challenging, how aggregation of such a flexible content will be handled.

NDC offers more flexibility than EDIFACT, so at some point it will play out its original benefits and yes, the GDSs will have to integrate it – the question is at what price and whether there is a kickback. It’s all about the timing and to maximize profits. Hence, I expect the current version not to be the last one – and still major changes ahead. Also, NDC will still learn lessons – as they did with the totally overloaded Air Shopping message of their earlier versions, which gets closer and closer to the way business was conducted in a pure GDS world.

The big question is, how will the business model change, as obviously there won’t be a kickback in NDC and now airlines have invited another player (their NDC provider, like Farelogix) who gets a piece of the cake. In my recollection the commercial model just simply doesn’t add up. For each TMC to integrate 500 airlines directly through NDC won’t work. For us as an aggregator, I already got a lot greyer hair by just integrating NDC to some extent. The fun part is that even though you have certification all this level 3 certification which sounds great, no one size fits all – there are too many optional areas.

On paper, if every airline is NDC Level 3 compliant, one should be able to copy the integration to Lufthansa 1:1 over to British Airways and American – right? However, there is only a subset of fields (= features) mandatory for each airline to comply with (and it remains to be seen whether even that subset implementation can simply be copied). A significant part is optional and up for interpretation. If Lufthansa wants to offer brewery tours for long stopovers in Munich (or a visit to the FC Bayern), what’s the equivalent for American in Dallas? A tour through the headquarters of the Chicago Cowboys in Frisco? And, will the airlines make sure they all use such provided optional fields in the same manner?

GDSs made sure that a seat is a seat – and that came with its own challenges: one provided a business class seat at an angle while the other one had a lie flat seat – but in the GDSs it looked the same. There is no ideal solution to the problem (and there never has been). In the past all looked the same but it wasn’t, in the future all looks different and comparison shopping will almost be impossible. Airlines need to differentiate and travelers need to understand the differences. Technology can help to some extent, but it is a business challenge that needs to be changed.

Especially for business travel a solid set of comparable features need to be available. It may be that airline brand differentiation becomes the major factor, however, then we have the problem with the hubs which are dominated by one airline. Every corporation will need several airlines to do business with extensively.

This is once again an area where TMCs probably need to sit at the table, as they know what subset of air ancillaries and features are important to their business clients. However, TMCs have not been part of the discussion so far as their eggs were in the GDS baskets who paid them large sums in the past. These days, I can see TMCs starting to realize NDC and carefully evaluating it (quietly to not jeopardize their GDS relationships).

Picture credit: Shutterstock

This Post Has 29 Comments

Thank you and I appreciate your comment.

Dear Vineet,

Thank you for your questions.

1. Going to airline.com sites is an option, but has nothing to do with NDC. NDC supposedly is a standard (in development) to avoid this and enable aggregators to aggregate the content from various airlines (in my graph the DC or Direct Connect aggregator). OTAs, TMCs, etc. would need to find an aggregator for NDC content and include it into their standard content hub of GDS content and low cost carrier content. Alternatively they can wait until GDSs (who now all committed to NDC) included NDC content. The whole article addresses this challenge. My follow up article https://www.travel-industry-blog.com/travel-industry/ndc-gds-onboard/ addresses where we stand more or less now.

2. NDC is only for air and has nothing to do with hotels or rental cars. Again for aggregation of such content you will need source content agreements with such provider (e.g. GDSs, hotel provider, LCC provider, etc.) and use an aggregator such as https://www.pass-consulting.com/en/industries/travel/travel-xml-api/ for the technical aggregation.

3. I guess interline and code share (https://www.travel-industry-blog.com/travel-technology/ticketing/) is one of the next steps of IATA to address in NDC, but I’m not aware of any implementation currently allowing this kind of service.

With regards to one order, I will create another post in a few weeks. Meanwhile there is information/links in my PNR for dummies post, as One Order is the replacement of the PNR: https://www.travel-industry-blog.com/travel-technology/pnr/

Thank you,

Michael

Dear Michael,

First of all, a very nice article and so thank you so much! As airlines are heading towards NDC, I have following queries, if you could please answer:

1. In NDC world, how will the B2B booking happen? Are the travel agents, OTA, Corporate Travle agencies supposed to go to each and every airline site and book from there?

2. In NDC world, who will aggregate the content across airline, hotel, cars etc?

3. In NDC world who will aggregate the content for interlining and code share scenarios?

It will also be useful if you could please shed some more light on offers and one order?

Hi Michael,

Thanks for this informative post – cleared most of my doubts about how NDC will impact the Industry. I wanted to check with you, if you could provide guidance (any papers, etc.) on NDC Sales and retail platform business architecture as well as business capability mapping for airlines undertaking NDC. Thanks a lot!

Dear Michael,

The book Sustainable Tourism Law was published, and we are preparing the new: Competition Law in Tourism.

Given the importance of the theme and similar to what happened in previous years, contributions are accepted from Colleagues who did not attend the Estoril conference.

I invite you and the readers of your excellent blog to write about the deep changes introduced by NDC.

We also focused on NewGen (IATA).

With my best regards

Carlos Torres

carlos.torres@eshte.pt

https://www.youtube.com/watch?time_continue=11&v=GZDIsOPheaA